Making ESG and climate reporting part of good governance

The Purpose Business previously presented five strategic sustainability priorities for Asian businesses, which include putting people first and leading with purpose while being held accountable. Although every sector and company is different, based on our experience, we believe these cross-cutting themes are all relevant in some way to major businesses across the region.

We then explored the first of the priorities - transitioning business models toward decarbonisation - and today we look at what the second priority means in practice: ESG and climate reporting as part of good governance.

Reporting is a journey

Companies report at various levels of detail and sophistication. All businesses have to start somewhere, and most evolve and refine their approach as they become more experienced.

At its most basic, an ESG report may provide an overview of a company’s key impacts, and how those are being managed. Global standards such as GRI and SASB, as well as local requirements such as those of HKEX and SGX, additionally require companies to define their most significant (or ‘material’) issues, report performance against those, and describe their overall sustainability governance structures and management mechanisms.

More advanced reporters may also disclose:

detailed performance across a range of fields, including, for example, progress against science-based targets (SBTs, for carbon reduction);

analysis of the sustainability-related concerns of stakeholders, based on systematic prioritisation of and engagement with key groups; and/or

comprehensive analysis of ESG/climate-related risks and mitigation measures (e.g. as part of a TCFD Statement).

Reporting and governance go hand-in-hand

As the sophistication of a company’s ESG reporting grows, so does the robustness of its overall governance and risk management.

It is often said that sustainability is simply a subset of good corporate governance, where ESG acts as a lens through which sustainability-related risks and opportunities can be seen more clearly. These might include physical risks from climate change, or new product and market opportunities arising from shifting consumer values and priorities.

The materiality requirement within ESG and climate reporting frameworks challenges the still widely held belief that sustainability is a ‘soft’ discipline or a ‘nice-to-have’. Rather, it demonstrates how an ESG focus can be of considerable value in highlighting potential threats to companies’ medium and long-term profitability – even viability.

Processes can be leveraged to embed sustainability

Specific processes that are typically part of ESG reporting can help embed sustainability – and therefore good governance and risk management – across the business.

Rigorous data monitoring and analysis are essential for producing credible ESG and carbon disclosures. That same data can enable the identification of opportunities to enhance sustainability impacts, leading to a range of other potential business benefits – such as reducing emissions by decreasing energy use, thus cutting costs.

GRI and other standards also encourage reporters to identify, engage and actively address the concerns of their key stakeholder groups, from employees and business partners, to regulators and policymakers, to affected communities. These stakeholders can often offer perspectives on sustainability-related challenges – and potential solutions – that a company’s leadership may not yet be aware of, or fully understand. Engaging them in a structured way can help illuminate the company’s blind spots.

Furthermore, reporting can be an effective way to enhance communication with stakeholders. Done right, it helps build understanding and trust – contributing to a range of benefits such as increased staff retention, increased client/consumer loyalty, improved access to finance, or a number of other commercial and business benefits.

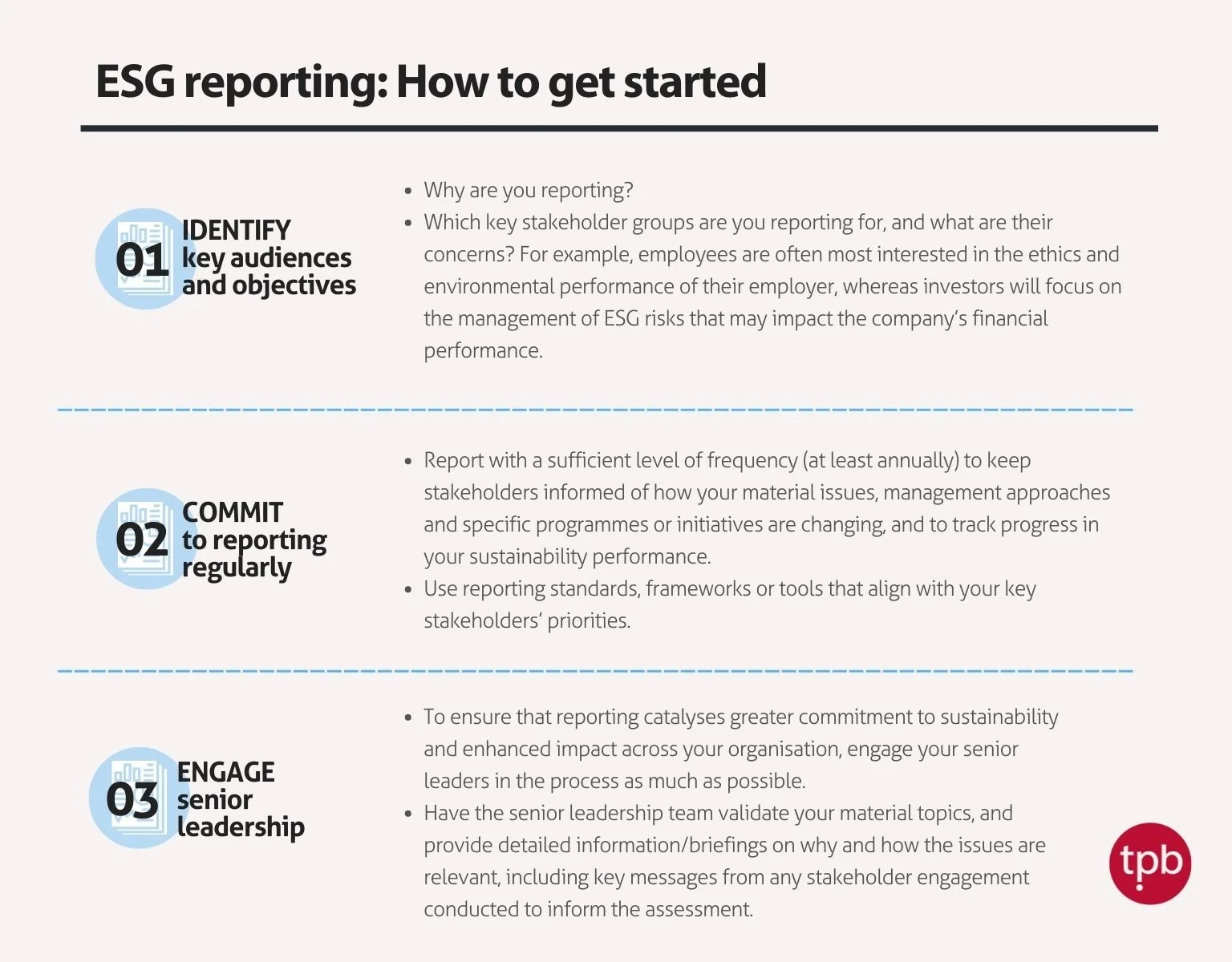

So, where to begin?

As 2022 comes to a close, this marks the third and final installment covering our strategic sustainability priorities for Asian companies, although they will continue to be relevant in 2023 and beyond for those looking to navigate this topic.

Main contributor: Simon Lee, The Purpose Business